Anticipated Interest Rate Cuts by the Federal Reserve: Economic Insights

As the Federal Reserve approaches its September meeting, the specter of potential interest rate reductions looms, stirring conversations within market circles. Recent signals from economic data suggest a shift in monetary policy that could significantly influence financial markets and consumer behavior alike.

Current Economic Landscape

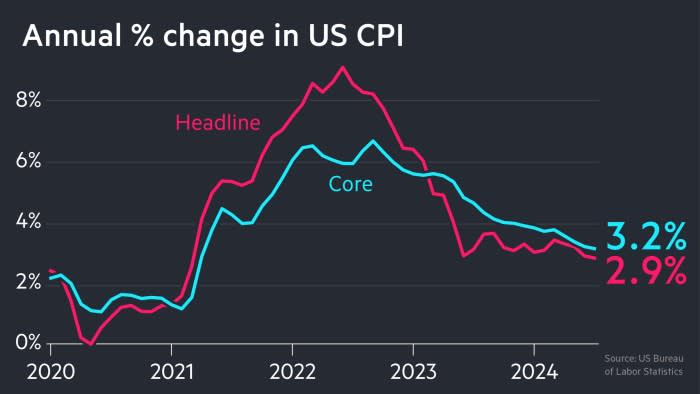

Investors are closely monitoring indicators that might prompt a reassessment of interest rates. Key metrics, including inflation trends and employment figures, reveal a complex picture of the economy’s health. For instance, the latest reports show that inflation has begun to stabilize around 3%, down from previous highs. This decline may provide the Fed with sufficient rationale to lower rates in hopes of spurring growth while ensuring price stability remains intact.

The Impact on Markets and Consumers

Historically, when interest rates are adjusted downward, there tends to be an uptick in borrowing as loans become more affordable for both individuals and businesses. Analysts anticipate that if rates decrease as some predict during this upcoming session, sectors such as housing—where mortgage costs directly impact purchasing power—could experience renewed vigor. For example, reduced mortgage rates could unlock opportunities for first-time homebuyers who have been sidelined by higher costs.

Moreover, with current consumer sentiment showing signs of optimism—recent surveys indicate over 70% of Americans feel positive about their financial situation—it is possible that easing credit availability could encourage spending across various sectors.

Looking Ahead: What’s Next for Monetary Policy?

While speculation surrounds potential cuts come September, it is essential to consider long-term implications on economic recovery efforts. A cautious approach will likely continue; central bank officials must balance stimulation against risks such as overheating or escalating inflation once again.

should the Federal Reserve proceed with interest rate cuts this fall—a measure supported by many analysts—the resultant ripple effects on both consumers and investors will be pivotal in shaping our economic landscape moving forward into 2024 and beyond.