A Common Scenario for Retired Educators and Former Candidates

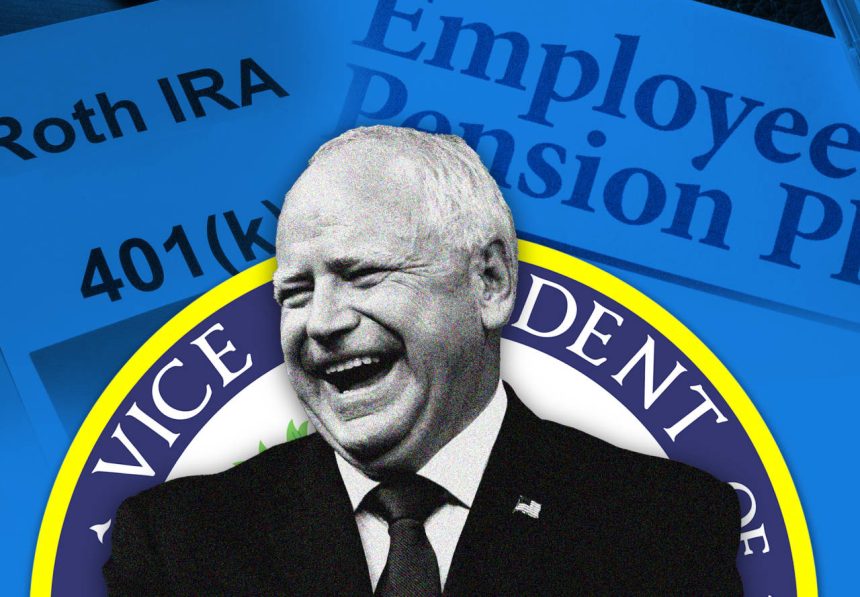

For numerous retired educators, the financial planning landscape often features a specific and predictable setup. Several familiar faces in this context include not only seasoned teachers but also political figures like a former vice-presidential candidate.

Understanding the Financial Landscape for Retirees

In an era where retirement planning increasingly leans on various investment strategies, many individuals still find themselves eschewing stocks and bonds. Instead, these retirees frequently rely on pensions as their primary source of income, raising questions about the conventional wisdom surrounding financial security during retirement.

The Case Against Stocks and Bonds

Recent statistics reveal that less than 30% of retired educators possess any stocks or bonds in their portfolios, a stark contrast to the general expectation that retirees should diversify their investments. This distinct approach to financial management becomes especially noticeable among those who prioritize stability over potential market fluctuations associated with equities.

Insights from Retirement Financial Strategies

The reliance on pensions among retirees may be rooted in both preference and experience. For example, studies show that teachers who have dedicated decades to public service often feel more secure depending on fixed-income streams from pensions rather than taking risks associated with stock market volatility.

New Perspectives on Alternative Retirement Income Sources

As we navigate an ever-evolving economic environment characterized by rising inflation rates—averaging around 3% annually as of late 2023—pension plans remain steadfast anchors for many. An increasing number of individuals are reconsidering traditional methods of asset allocation in light of current economic trends.

Conclusion: Rethinking Retirement Security Plans

Ultimately, while diversifying investments through equities may work well for some, it’s essential to acknowledge that many find solace in stable pension arrangements post-retirement. This trend is reshaping our understanding of what constitutes sound financial practices for those stepping into life after work—a reality shaped by personal circumstances rather than widespread conventions.